The gaming industry has long recognized the power of branding and fan loyalty, and nowhere is this more evident than in the rise of themed credit cards featuring popular game characters. Over the past decade, financial institutions and gaming companies have increasingly collaborated to create co-branded credit cards that cater to dedicated fans. These cards not only serve as a financial tool but also as a statement of identity for gamers who want to showcase their passion in everyday life.

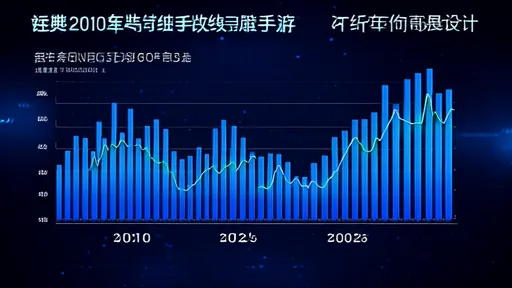

Tracking the data behind the issuance of these cards reveals fascinating trends. Major franchises such as Pokémon, League of Legends, and Final Fantasy have seen tremendous success with their themed credit card offerings. The Pokémon Card from JCB in Japan, for instance, reported over 500,000 active users within its first two years of launch. This demonstrates how deeply embedded these characters are in consumer culture, transcending the boundaries of mere entertainment to become lifestyle symbols.

What makes these cards particularly appealing is the exclusive perks they offer. Cardholders often gain access to limited-edition merchandise, early game releases, or special in-game content unavailable to the general public. For example, the World of Warcraft themed card by Chase provided users with exclusive mounts and pets, creating a direct link between financial spending and in-game rewards. This strategy has proven highly effective in driving adoption among dedicated player bases.

The demographic data tells an equally compelling story. Contrary to some expectations, these cards aren't just popular among younger audiences. Market research shows significant uptake among professionals aged 30-45 who grew up with these franchises and now have the disposable income to indulge in premium offerings. This has led financial institutions to design cards with more sophisticated benefits, including travel rewards and concierge services, while maintaining the core gaming theme.

Regional variations in adoption rates provide another layer of insight. Asian markets, particularly Japan and South Korea, have shown the highest penetration rates for gaming-themed credit cards. This aligns with broader cultural trends where gaming enjoys mainstream acceptance and where collectible items hold particular social cachet. Western markets, while growing, have been slower to embrace the concept, though recent partnerships between major US banks and esports organizations suggest this may be changing.

From a business perspective, these collaborations represent a win-win scenario. Game publishers gain a new revenue stream and increased brand visibility, while banks tap into the passionate loyalty of gaming communities - a demographic traditionally underserved by financial products. The data shows that gaming-themed cardholders tend to have higher engagement rates than traditional card users, with increased transaction frequency and greater responsiveness to loyalty programs.

Looking ahead, the market shows no signs of slowing down. With the continued growth of the gaming industry and the increasing integration of digital and physical financial services, we can expect to see more innovative partnerships. Virtual credit cards featuring dynamic character art that changes based on spending habits, or cards that offer blockchain-based game assets as rewards, may soon move from concept to reality. What began as a niche marketing experiment has evolved into a significant financial product category with global appeal.

By /Jul 29, 2025

By /Jul 29, 2025

By /Jul 29, 2025

By /Jul 29, 2025

By /Jul 29, 2025

By /Jul 29, 2025

By /Jul 29, 2025

By /Jul 29, 2025

By /Jul 29, 2025

By /Jul 29, 2025

By /Jul 29, 2025

By /Jul 29, 2025

By /Jul 29, 2025

By /Jul 29, 2025

By /Jul 29, 2025

By /Jul 29, 2025

By /Jul 29, 2025

By /Jul 29, 2025

By /Jul 29, 2025

By /Jul 29, 2025