The account security insurance sector has witnessed significant growth in recent years, driven by escalating cyber threats and heightened consumer awareness. As financial institutions and tech companies scramble to offer protection against unauthorized transactions and identity theft, one metric stands out as a critical benchmark for the industry: the claims payout ratio. This figure, representing the percentage of premiums paid out as claims, serves as a bellwether for product sustainability and market maturity.

Understanding the Payout Ratio Dynamics

Across the insurance landscape, account security products occupy a unique niche. Unlike traditional insurance lines where actuarial tables rely on decades of historical data, cyber risk models remain in relative infancy. The global average payout ratio for account security insurance currently hovers between 65-75%, according to data aggregated from major markets. This places it notably higher than auto insurance (55-65%) but lower than some specialty lines like travel insurance (80-90%).

The variance stems from several structural factors. First-party coverage for stolen funds tends to trigger more frequent claims than third-party liability policies. However, the actual loss amounts per claim often prove smaller than initially feared, thanks to banking safeguards like transaction monitoring and two-factor authentication. This creates a counterintuitive scenario where claim frequency remains elevated but severity stays manageable.

Regional Variations Tell a Story

Digging beneath the global average reveals striking geographical disparities. North American providers report payout ratios clustering around 68-72%, reflecting relatively mature fraud detection ecosystems and standardized claims processes. European markets show slightly higher ratios at 70-75%, partly attributable to stronger consumer protection laws that expand coverage triggers.

Emerging markets present a different picture entirely. In Southeast Asia and Latin America, where digital banking adoption has outpaced security infrastructure, payout ratios frequently exceed 80%. The inverse relationship between financial inclusion and account security becomes painfully visible here - as millions gain access to mobile banking, fraudsters gain fresh hunting grounds.

The Fraud Tsunami's Impact

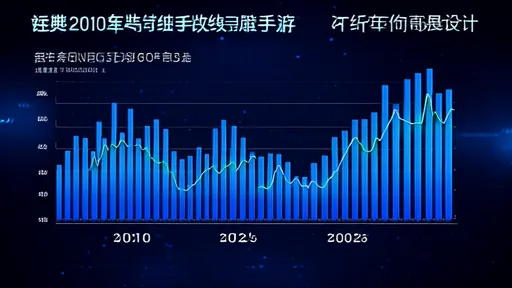

Industry analysts observe a worrying trend: the payout ratio creep. Where five years ago the sector average stood at 60-65%, the upward migration reflects both sophisticated attack vectors and shifting criminal tactics. Synthetic identity fraud - blending real and fake personal data - now accounts for nearly 30% of claims in some markets, up from single digits in 2018.

Social engineering scams present particular challenges. When policyholders willingly transfer funds to criminals posing as bank officials or romantic partners, disputes erupt over whether these constitute "unauthorized transactions." Some insurers have responded by introducing sub-limits for social engineering claims, effectively capping their exposure.

Product Design as a Lever

Forward-thinking carriers are engineering policies to maintain sustainable payout ratios without gutting coverage. Common strategies include implementing waiting periods (typically 30-90 days after policy inception), requiring multi-factor authentication enrollment, and offering premium discounts for customers using biometric verification.

The most innovative products incorporate prevention tools directly into the coverage. Some policies now include free credit monitoring, dark web scanning, or even concierge services to help secure accounts before breaches occur. This proactive approach appears effective - early data suggests such value-added policies experience 15-20% lower claim frequencies.

The Reinsurance Factor

As primary insurers grapple with volatile claims experience, reinsurance markets have stepped in to provide stability. Excess-of-loss treaties now commonly protect carriers against catastrophic fraud events, like simultaneous breaches across multiple financial institutions. This risk transfer mechanism helps explain how insurers maintain relatively stable payout ratios despite rising cyber threats.

However, reinsurance capacity isn't unlimited. After several years of heavy cyber losses across all insurance lines, reinsurers have begun tightening terms for account security coverage. Some now require primary carriers to retain more risk or exclude certain attack vectors altogether. This hardening market could pressure payout ratios upward if insurers can't offset the changes with improved underwriting.

Consumer Behavior Matters

Perhaps the most underappreciated factor affecting payout ratios is policyholder vigilance. Data from insurers reveals stark differences in claim rates between engaged and disengaged customers. Those who regularly review account statements and enable all available security features file 40-50% fewer claims than those who take minimal precautions.

This insight drives many insurers' educational initiatives. Rather than simply pricing risk, leading providers invest in customer cybersecurity awareness programs. The rationale is clear: an informed policyholder base not only reduces claims but builds brand loyalty in a market where many consumers still view account security insurance as a commodity.

The Road Ahead

Looking forward, industry observers expect payout ratios to stabilize rather than retreat. The dual forces of improved fraud detection and increasingly brazen criminal tactics will likely cancel each other out. However, the definition of "average" may shift as embedded insurance grows - with financial institutions baking coverage directly into account fees rather than selling standalone policies.

One certainty emerges from the data: account security insurance has evolved from niche product to necessity. As the digital economy expands, so too will the need for financial safeguards. The insurers who master the delicate balance between robust protection and sustainable payout ratios will define the next chapter in this rapidly evolving sector.

By /Jul 29, 2025

By /Jul 29, 2025

By /Jul 29, 2025

By /Jul 29, 2025

By /Jul 29, 2025

By /Jul 29, 2025

By /Jul 29, 2025

By /Jul 29, 2025

By /Jul 29, 2025

By /Jul 29, 2025

By /Jul 29, 2025

By /Jul 29, 2025

By /Jul 29, 2025

By /Jul 29, 2025

By /Jul 29, 2025

By /Jul 29, 2025

By /Jul 29, 2025

By /Jul 29, 2025

By /Jul 29, 2025

By /Jul 29, 2025